-

Chronicle - The Dawn of a New Era

I once had a social studies teacher in middle school who spent many class hours hammering home the idea that the only things in life that remain the same - always the same - are death and taxes. At the age of 12, I found that idea hard to grasp. As I progressed through school and then life, I began to fully comprehend what he meant.

The only real constant in our lives is change. This is nowhere more visible than in a vibrant, living industry like the luxury mechanical watch world. Change has accompanied me since the start of my career in watches in 1991, but only this year has become apparent just how much things the current era is pushing forward.

Last Basel in this constellation

As Baselworld was drawing to a close, Worldtempus editor-in-chief Louis Nardin said to me, not without a touch of regret, "This will be the last Basel in this constellation." Naturally, he was referring to the obvious, visual changes going on around us at the fair, but he was also talking about our own situation here at Worldtempus. Louis will be leaving on a personal ten-month journey in a few weeks and thus leaving this position. I see this as a big loss for the industry: his fresh and exciting voice has lent the French-language watch media a decidedly new and eager attitude.

Looking around Baselworld with nostalgic eyes on my final day of the fair, the day after Louis had already departed for Geneva, I couldn't help but think back over the last 22 years since I had first arrived in Basel a fresh-eyed, eager student of things to come. Only a few years out of college in my early twenties, I had literally never seen anything like it before. Even visitors to Baselworld today would have a hard time visualizing what I am about to describe thanks to a major overhaul of the fair that took place in 2000 after the departure of the LMH brands (IWC, Jaeger-LeCoultre and A. Lange & Söhne) to join their Richemont sisters at the SIHH.

Back in the day, entering Hall 1.0 was like going through the doors to suddenly find yourself on the world's ritziest street, one solely lined with jewelers housed in marble stores, their "storefronts" displaying the world's most collectible and expensive watches. Each booth didn't have much in the way of personality as I recall, and Patek Philippe put on an annual cocktail party back then, which allowed a degree of networking as one perused the new products - out in the open, mind you, with much less thought to security or exclusivity than is practiced today. The halls were definitely arranged with hierarchy in mind, with the "most important" brands in front, trailing down toward the "lesser" brands toward the back. This hierarchy was dictated by the fair in conjunction with the Swiss exhibitors' committee.

Near where the Swatch Group pavilion has been situated for the last twelve years was the spot where the original escalator to the upper floor was located. And alongside the escalator ranged a three-story marble booth: Tiffany held court here, and the usual Friday morning "Breakfast at Tiffany" was always a much-anticipated press event.

With the renewed halls of 2000 something else arrived: a decidedly corporate feel to the fair. What was previously a jovial gathering (or so it felt to me), had definitely now become big business. Gone was the Birrabella fast-food lunch spot, where one saw Patek Philippe's then-president Philippe Stern eating his noon sausage alongside the likes of me. Gone were the cute little nooks and crannies that the gradual additions to the fair buildings created (why should this building be any different than any other oft-annexed Swiss factory?). The cool thing about that was you never knew what you were going to encounter when you turned one of those corners. It might have been Armin Strom standing next to a glass case filled with his latest hand-skeletonized and engraved pocket watches and the odd wristwatch. It might have been a little raclette restaurant where you spied Daniel Roth having lunch with a collector. Or it might have been Nomos or Sinn tucked away in little rooms that passed for booths in the "Centre Commercial" next to a dial supplier. Hall 1 seemed absolutely magic back then, and much of that impression came from the unknown - what or who you were going to run into next was often a bit of a mystery.

Change of guard

If it hasn't been apparent up to now, it should be with this statement: a changing of the guard has taken place in the watch industry. The "corporatization" of Baselworld is only one of the outward signs - and make no mistake, Baselworld has become big business for all involved.

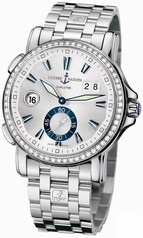

This first Baselworld without Rolf Schnyder seemed a little empty too. Rolf, who bought Ulysse Nardin in 1982, passed away last April at the age of 75. He was one of the proponents of some of the biggest technological changes in our industry - occurring within the deep recess of the mechanical movement's heart, almost imperceptibly to the consumer - it was somehow comforting to see him sailing the UN booth tucked back in the corner of Hall 1.0 as the captain. If you listened hard, you could hear his booming laughter wafting down from the top floor of the booth overlooking much of the busy hall. Naturally, Patrik Hoffmann has stepped up to take control the way that Rolf had probably foreseen, and by the end of Baselworld 2012 he was reporting a record year for sales.

Jack Heuer also announced his retirement from the company that bears his name, and nostalgically I stared after him every time he crossed my path at the fair this year. What will TAG Heuer do with that futuristic new booth next year when it is part of the LVMH pavilion that is in planning for Hall 1.0? And whose soul will maintain the equilibrium needed to maintain b ties to its industry proponents?

Another cornerstone of Baselworld has also bid adieu after the 2012 edition of the fair: Jean-François Meyer, head of the promotional affairs department of the Federation of the Swiss Watch Industry (FH) and secretary of the Baselworld Swiss Exhibitors Committee. Baselworld is just not going to seem like Baselworld without seeing Jean-François' friendly face flitting around the press center and helping journalists find press releases and making sure all is running smoothly. He told me this would be his last Baselworld and he is looking forward to retirement at the end of the year.

This is also the first year I have visited Baselworld without having seen Armin Strom. Mr. Strom retired several months ago, leaving the company that bears his name in the capable hands of CEO Serge Michel and technical director Claude Greisler.

And next year?

We shall see what next year's fair looks like when the end of April 2013 comes around. In all the years I have been attending Basel, it has never been this late in the year. It already seems strange now, but then so did the extremely early date of the 2012 edition. Until I got there and things started rolling, that is. And that is precisely how we are going to feel next year too. Instead of heavier early spring clothes, we'll be looking out summery clothing to wear over the course of the fair. The white asparagus will be of the local variety instead of the imported-from-Peru quality. For certain, the outside surroundings will be beautifully decorated with fresh spring flowers and we will all marvel at the completed addition that will connect Hall 1 with Hall 3. I can't even begin to predict what the inside will look like, but I do know that it will be a time of discovery, for I won't have the layout of the fair mapped out in my head anymore and will finally have to download and consult the Baselworld app to find my way to my appointments. Did I just say app? Yep, I guess change really is a constant.

But perhaps the biggest change at Baselworld will be the new show of "forces," as Louis puts it. We think that the main halls will have less space dedicated to the "little guys" and more space dedicated to the group "pavilions": Swatch Group, LVMH (which includes Hermes and Bulgari, the latter moving over from Hall 4.0) and the Gucci/PPR Group (including Girard-Perregaux's return to Baselworld). The less known brands will be stepping aside to allow the decided spotlight to shine on the very powerful.

Well, the one thing that never stays the same is change, I guess. Welcome to the beginning of a new era in many, many ways. Welcome to a big, new corporate future for luxury watches.

-

Distribution - Retailers Need Alternatives to Big Brands

WORLDTEMPUS - 27 October 2011

After having been in charge of the regional sales for the Movado brand and holding the position of commercial director of Vacheron Constantin for North America, Norm Kushner became president of Rabco Luxury Holdings, LLC in 2000, which carried brands as varied as Breguet, Graham, Arnold and Eberhard & Co. When this firm disbanded in 2010, Kushner founded Swiss Watch Consultants, his own distribution company based in Manchester, New Hampshire. It currently represents Eberhard & Co and Glycine. Considering the increase of mono- and multi-brand boutiques run by watch groups, he is of the opinion that independent brands will become the preferred alternative for retailers in the next five years.

Anaïs Georges du Clos: You think that independent distribution in North America is going through a deep structural evolution. Why?

Norm Kushner: In the old days, the only way for a brand to conquer the American market was to work with a local distributor who had good relations with specialized retailers. In the last several years, big independent brands like Audemars Piguet and Ulysse Nardin have founded their own distribution structures. In parallel, prestigious brands like Cartier, Omega and Hublot have started to open their own boutiques in every big American city. This integration strategy, which leads to a maximization of margins, penalizes both distributors and retailers.

How?

Brands that now own their own boutiques stopped working with many independent retailers. Omega is a perfect example with its 21 shops throughout the USA. Omega only works with one retailer in Manhattan: Kenjo. Brands also invest a lot in communication to promote their own boutiques and reserve special or limited editions for them.

Can you quantify this phenomenon?

After SIHH 2011, I estimate that 15 percent of North American retailers lost their agreements with important brands.

Which cities are most affected?

The biggest ones first: New York, Los Angeles, Beverly Hills, Miami, Chicago. In these cities, there are mono-brand boutiques of Richemont brands like Cartier, Vacheron Constantin and Panerai, and the multi-brand Tourbillon shops (Swatch Group) have also increased. Mid-sized cities are also affected, but are less easy to work in without the help of big local retailers.

Do you think this evolution is definitive?

In the end, I imagine that big brands' watches will only be available in their own boutiques.

What are the consequences for distributors and agents?

As the groups don't want to work with them anymore, they'll have to find alternatives. The independent brands are interesting, also because they don't have enough resources to behave as the big brands do. For them, the agent and the distributor are the best interlocutors. For the latter, the risk is immense as he has to finance a stock of hundreds of watches. Thus, he works almost like a bank during the time the orders are being taken, and is paid only when the retailer can remit. This period can last up to a hundred days. This is the reason why distributors like us zero in on independent brands who enjoy a worldwide reputation and proven financial stability.

What impact does this integration process have on brands that belong to groups?

In the short term, sales decrease and brands make less money in comparison with the time they were working with independent retailers. But, the difference becomes less and less significant with time. In the end, the benefit should probably justify the groups' choices. For independent brands, this tendency will create interesting opportunities in the next five years, but only if they invest in communication. As contracts last three to five years, brands have to support these costs.

And for retailers?

If they want to remain in competition, they must continue to buy large quantities to maintain their margins. Some of them chose an other strategy by opening monobrand boutiques next to their multibrands points of sell.

Are brands so powerful that retailers want to continue to work with them, whatever the price of it may be?

If retailers can afford important sacrifices to stay with the brands they know, then the decision must be based on the profitability of the deal. Many retailers have given up working with certain significant brands.

What is the impact of this tendency on the customer?

Mathematically, we should see more independent watch brands in retail shops. As for products from group-associated brands, discounts should be harder to negotiate now.

-

Culture - The Egg and the Watch

WORLDTEMPUS - 21 avril 2011

Dictated by its difficult geometrical shape, the egg remains a rarity in modern watchmaking. But historically speaking, it is the egg that gave birth to modern portable watches. Starting with what is known as the Nuremberg Egg, it shows up from time to time -now notably in modern interpretations by the likes of Ladoire and Breguet.

Historians are pretty much unanimous in citing the Nuremberg Egg as the first portable watch. Peter Henlein's watch, ran reliably for about 48 hours, with its diameter of about six centimeters is pinpointed as the first miniaturized mechanical clock. Tambours, considered fashionable, were worn around the neck at that point in time. Now on display in Nuremberg's Germanic National Museum, this drum (or tambour) watch was made in the mid-1500s.

Faberge

Peter Carl Faberge, born into a Huguenot refugee family in 1846 in St. Petersburg, was famed for his enamel and jewelry. Between 1885 and 1916, Faberge (named official court jeweler in 1910) created more than fifty egg-shaped Easter gifts for the czar family, most of which were commissioned as surprises. The first egg, a chicken's egg, was a gift from Czar Alexander III to his Danish wife, known by her Russian name as Maria Feodorovna. The last egg, made in the year of the October Revolution, was named the War Egg.

Victor Mayer, Faberge's last workmaster, situated in Pforzheim, Germany, created a new generation of eggs beginning with the first post-revolutionary example, which was presented to Mikhail Gorbachev as he received the Nobel Peace Prize in 1991.

The most horologically complicated egg was completed in collaboration with master watchmaker Paul Gerber of Zurich: the Moon Phase Clock Egg from 2001, a limited edition of twelve pieces. Made of gold, onyx, rock crystal, and rose quartz, the body of the egg was crafted in hand-guilloche gold and completed with translucent light blue enamel. The moon phases are shown on a navy blue enameled sky with gold leaf stars. The white gold moon is set with paved diamonds and onyx to display the moon phases. The movement created by Gerber is an eight-day mechanical movement outfitted with twin spring barrels, a swan-neck fine adjustment, and a Breguet overcoil balance spring. The hours are visible in a window made of rock crystal on the side of the egg, while the minutes can be seen on the gold ring located directly above it. Every day at noon, "Clair de Lune" by Claude Debussy sounds from a musical movement found hidden in the gold-and-onyx pedestal.

Russian honor

Honoring the Russian market, Ulysse Nardin released two very limited watch editions housed in enameled eggs crafted by an internationally famous contemporary Russian jeweler, Andrei Ananov of St. Petersburg. Two Eggs of the Tsars were released: one honoring the Kremlin (2005) and one honoring St. Petersburg (2009).

Queens and kings

Breguet is the first brand to have reproduced the egg shape in a wristwatch: the Queen of Naples, introduced in 2002. Reserved for females—fitting since it is they who reproduce life with the help of eggs—Breguet's Queen of Naples has become a popular part of the high jewelry collection, reinvented anew every year.

There is also an egg for men containing the king of complications thanks to pre-Richemont Minerva: the Tourbillon Heures Mysterieuses came out in 2005 and morphed into Montblanc's Grand Tourbillon Heures Mysterieuses in 2009 after the takeover.

The oblong shape of the egg seems to also be finding a home in the futuristic places that watchmaking is now heading. Ladoire's Rolling Guardian Time was designed by Lionel Ladoire and became a signature element of his boutique brand's look - particularly in 2008 when Ladoire debuted thanks to the more opulent angles and structures of the case, which have meanwhile softened a bit.

The latest example is, of course, Hublot's Key of Time. Like a science fiction novel, this model was reborn from the remains of BNB's demise and has now taken on an entirely different, post-modern look - reminiscent of an egg.

And, speaking of rebirth, Zenith naturally pops to mind. The Christophe Colomb, whose case is round, contains a sapphire crystal with two half-globes protruding from either side. The effect, particularly of the rotating escapement inside, is decidedly egg-shaped.

These sorts of Easter eggs have always been accompanied by a certain price. Henlein's Nuremberg Egg is priceless. Zenith's Christophe Colomb, a limited edition of 25 pieces, goes for something like 210,000 Swiss francs, and Breguet's Queen of Naples starts at around 15,000 Swiss francs and heads into the clouds with the addition of jewels and complications.

Rest assured you probably won't find them in your Easter basket on Sunday.

-

Las Vegas Show - Haute Appeal

WORLDTEMPUS - 18 June 2010

Lisa Roman, marketing director for Breitling USA, took a break between appointments at the Couture show in Las Vegas earlier this month to show off her calendar, which listed a series of back-to-back meetings with what could be termed the "who's who of American watch retailers."

Given that most people with a stake in the watch business attended the Baselworld fair in Switzerland, held in late March, Roman's appointments might have struck some as an exercise in deja vu. But from her perspective, Las Vegas fills an important gap in the marketplace.

"Some of these people we didn't see in Basel," Roman said. "Some are longstanding accounts, some are new, some are prospects. Las Vegas is a place to connect with your customers."

Baselworld may be the granddaddy of all watch fairs, but the economic crisis has exacerbated a trend among American retailers who now routinely skip Basel in favor of attending buying week in Las Vegas. While neither Rolex, Patek Philippe nor any of the Richemont brands—Cartier, Panerai and IWC, for example—make the journey west, scores of big-name watchmakers do. They range from haute favorites such as Ulysse Nardin and Chopard to independent makers such as Frederique Constant and Girard-Perregaux to mass-produced quartz brands such as Timex.

What happens in Vegas stays at one end of The Strip

Watchmakers choose to show their wares at one of three gatherings located in the middle of the Las Vegas strip: the Couture show at Wynn Las Vegas, which appeals to both upscale and fashion brands; the JCK show at the neighboring Sands Convention Center, occupied by numerous quartz manufacturers; and a satellite show called Swiss Watch by JCK, which allows brands such as TechnoMarine, Bedat, and Corum to welcome buyers in private suites in the Venetian Resort Hotel.

Retailers, especially those who like to travel with an entourage of salespeople, appreciate Las Vegas for both financial and logistical reasons, but the event isn't without benefit to the brands themselves. Marc Hruschka, President and CEO of Chopard USA, said the show allows his team to consummate marketing and advertising strategies hatched earlier in the year.

"About four years ago, we left Couture and came to JCK," he said. "At the time, this was a better environment; all our clients were here and circulating and it was difficult to get them to Couture."

So what about next year, when the JCK show moves to Mandalay Bay, at the south end of The Strip. Will it force many retailers to divide their loyalties?

"That's a question," Hruschka said. "It's up in the air."